US PPI Rises, Signs of Inflation, "Will the Fed delay rate cuts?"

US Producer Price Index (PPI) Rises, Signs of Inflation... Will the US FOMC Delay Rate Cuts?

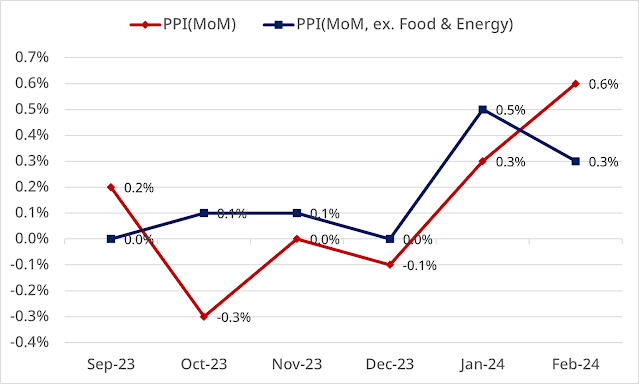

U.S. PPI sees 6-month high

The Producer Price Index (PPI) affects the Consumer Price Index (CPI). An increase in PPI can lead to an increase in CPI, usually with a 6-month lag.

Based on the February 2024 PPI, it is likely that CPI and consumer prices will be higher by August.

|

| US PPI Rises, Signs of Inflation |

Will the U.S. Federal Reserve (Fed) FOMC Delay a Rate Cut?

FOMC meets next week (Nov. 19-20)

|

| PPI; FRED |

Looking at the February 2024 PPI, inflation excluding food and energy prices was slightly lower than the previous month at +0.3%. However, the PPI was at its highest level in six months at +0.6%. Both were above expectations.

The PPI is considered a leading economic indicator and, assuming a six-month lead, suggests that higher prices are likely to persist through the middle of the year.

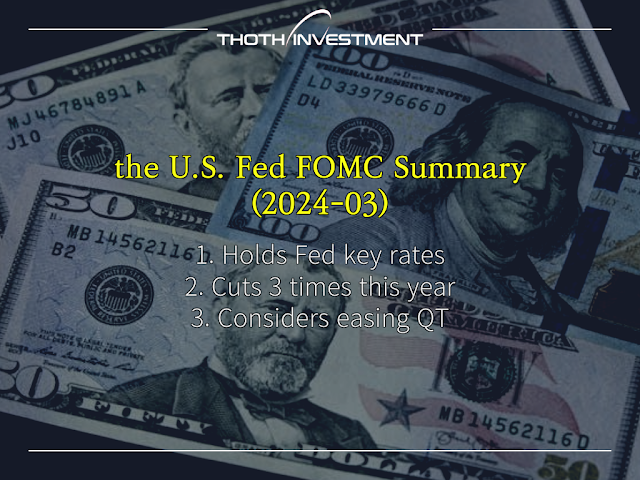

Looking ahead to the US FOMC meeting next week (19th-20th), the CPI and PPI releases suggest that inflationary pressures are still high, and we can expect a significant delay in the June rate cut.

The March 2024 US FOMC is expected to keep rates unchanged, but we expect equity markets and market rates to fluctuate depending on the content of Fed Chair Jerome Powell's press conference.

Powered by, THOTH Investment

Comments

Post a Comment